Why FMCG Brands Fail with ‘Direct-to-Consumer’

July 14, 2021 By Yana Persky

- You will gain an in-depth perspective on the growing trend of Direct-to-Consumer (D2C) retail, particularly in the context of Consumer Packaged Goods (CPG) brands.

- You’ll explore why many CPG brands have been increasingly adopting D2C models, despite the challenges and failures they have encountered.

- You'll get a break down the realities behind D2C adoption, especially regarding profitability, scalability, and the significant upfront investments required.

- You will learn how D2C channels have been used beyond sales as a valuable source of consumer data, gaining insight, and testing new products.

I recently decided to compare the number of Google search results there are for both “Direct to Consumer retail” and “B2B eCommerce retail”. It didn’t take me long to realize that my next blog post would be about the D2C model and the real motives behind adopting it.

While there were 13.1 million results for “B2B eCommerce retail”, D2C had a whopping 387 million results. Such a high number didn’t make any sense to me, and trying to make sense of it, the only logic I could find is that the D2C model has been hyped up so much that CPG brands, no matter how successful their B2B sales models are, have been brainwashed for years that by establishing a direct relationship with their customers through D2C, their profitability and scalability will see the most success.

Maybe you’ve already noticed that more CPG brands are adding D2C, and the pandemic has accelerated the trend. PepsiCo launched two D2C websites; PantryShop.com and Snacks.com, where US customers can order their food and drink ranges. Heinz launched its first D2C business line to offer a package of shelf-stable foods such as spaghetti, beans, soups and sauces for delivery to customers’ doorsteps in the UK. To supply household cleaning and personal care items in Brazil, Unilever teamed up with Rappi, a delivery service. In Chile, Coca-Cola created an eCommerce website to distribute soft drinks, juices, water and alcohol directly to customers.

Pro Tip: For CPG brands, particularly in FMCG, it may be more beneficial to enhance traditional B2B sales channels rather than focusing on D2C. Streamlining B2B processes and automating sales can make operations more scalable and cost-effective.

When launching a D2C channel, most of these multinational CPG brands hoped to unlock another high margin sales channel, but instead found disappointment and failure. Simply opting to sell directly to customers does not guarantee that you will make a profit.

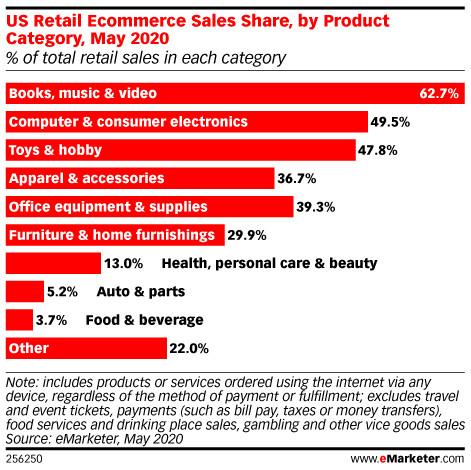

Prior to the pandemic, online grocery sales were on the rise, but they still made up a tiny fraction of the market share, accounting for just 3.7% of total US food and beverage sales in 2020. eCommerce penetration is also low for the health and beauty industry (13%) with Amazon accounting for 44.3% of these online sales in the US. So this already small online penetration limits the addressable market even further if D2C is added as a primary channel.

Pro Tip: If you do venture into D2C, treat it primarily as a tool for collecting consumer feedback and insights. It’s a valuable channel for understanding consumer preferences, testing new ideas, and gathering real-time reactions that can guide future product development.

D2C is another form of business, and requires a significant upfront investment in technology, logistics and resources. Consumers want the ability to choose from a variety of brands and models in all flavors, sizes and colors. They also expect “same day” or at the very least “next day” delivery. However, none of these D2C manufacturers carry other brands – so consumers still prefer to buy at the supermarket rather than place multiple orders on different websites.

Most CPG brands have a well-established, traditional distribution network and adding D2C will inevitably lead to a channel conflict with its pricing, logistics and product complexities. To avoid channel conflicts many brands are forced to change their strategy and offer exclusive products that come with different packaging – further increasing their operating expenses.

Having experimented with D2C, many CPG brands have come to the conclusion that it is neither profitable nor scalable. So why are they still investing in D2C? The answer can surprise you:

“What is different about this is we’re getting data on what people are doing versus what they say they will do.” said PepsiCo’s Senior VP and Head of eCommerce Gibu Thomas. “People are voting with their wallet, so we know exactly what resonates … The quality, fidelity and speed at which we get consumer feedback is just changed by having this direct touchpoint with the consumer.”

Pro Tip: D2C channels come with significant upfront and ongoing costs, especially when it comes to logistics and technology. Be mindful of these costs and weigh them carefully against the potential benefits of direct consumer engagement.

According to Jean-Philippe Nier, head of eCommerce for Kraft-Heinz’s in the UK and Ireland, “The long-term window of this platform is to get closer to our consumers. We’ve got a lot of ideas to create more bespoke products for this website. Longer term, we see real value in this channel to be an insight and data channel for us. It’s amazing, the amount of data you can collect on your shopper – feedback from them on products they want to see – where we can test and learn. It could be trying new products, getting feedback from our consumers and then scaling it and launching it into the market…. I don’t think it will ever be a huge channel but it will play a very different role for us.”

And Woodrow Levin, Founder & CEO of extended warranty startup Extend said, “It’s fantastic to have that much contact with customers, but it is definitely not scalable. What you will get from interacting with customers at that level is amazing feedback on your business, and that is invaluable. No survey or research firm is going to give you that kind of information.”

Pro Tip: While D2C offers unique advantages, be aware of its scalability limits, particularly for FMCG brands. Consider the long-term sustainability of this model and how it aligns with your broader business strategy.

This blog post is not meant to discourage you in any way, but to give you another perspective. Some brands, particularly FMCG, may be better off sticking with traditional B2B sales channels rather than going D2C. I would even advise them to automate their B2B sales processes to become more scalable and efficient. If you do choose to explore D2C, it’s still a great way to collect consumer insights and innovate with new ideas before launching new products.

Key Takeaways

- D2C requires substantial investments in technology, logistics, and resources. Additionally, brands must provide rapid delivery and manage a complex range of consumer preferences, which complicates operations and raises costs.

- Many brands, despite recognizing the challenges of D2C, still invest in this model primarily for consumer data. D2C offers direct feedback from customers, allowing brands to test products, gather insights, and refine offerings in ways that traditional research cannot match.

- The D2C model is not always scalable or profitable for many brands, especially in the FMCG sector. Many companies have concluded that the model does not drive significant revenue but provides valuable feedback and insights that can inform future product innovations. This approach allows for more bespoke, customer-focused product development.